The resale HDB market presents a rather strange situation where older flats are typically priced higher than new ones. There are multiple reasons for this, including a shorter waiting time compared to a BTO, bigger-sized flats and being situated in mature estates.

But with HDB flat prices reaching over a million dollars in recent years, such high transaction prices have raIsed some concerns about the unaffordability of public housing, as well as the intent behind buyers who pay such hefty prices. One common assumption is that older HDBs have a higher chance of being eligible for the Selective En-bloc development Scheme(SERS), where HDB will buy over the flat and offer home-owners a chance to buy a replacement HDB unit.

But National Development Minister Lawrence Wong reminded Singaporeans in a recent blog post that not all old flats will be eligible for this scheme and that “buyers need to do their due diligence and be realistic when buying flats with short leases”. As HDB flats are on a 99-year lease, they will be returned to the state when the lease runs out, with prices falling correspondingly.

So before buyers take the plunge to pay top-dollar for their resale HDB flats, let us examine some of the common assumptions surrounding resale HDB flats and where the most expensive HDB flats are in Singapore.

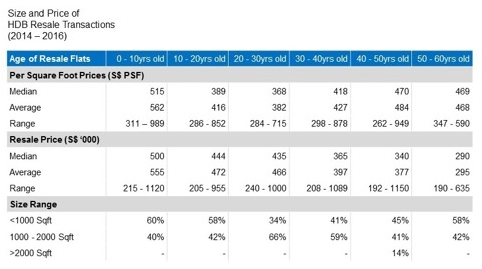

Assumption 1: The Older The HDB, The Cheaper It Is

Most people prefer something new, especially when it comes to buying property. Getting a new property probably means you spend less on renovation and the property is less susceptible to wear and tear. However, that’s not always true.

There are indeed a number of factors that account for older HDB flats to be priced at a higher price – other than the potential for SERS, they are usually located in mature estates where amenities are aplenty and are more accessible. Given that the average HDB size is bigger than newer flats, they are naturally more expensive as well. In fact, we found that buyers typically become price-insensitive once the HDBs are older than 30 years old.

The above table shows that the average price for resale HDB decreases from year 10 to 30, but becomes pretty stable between $427 to $484 PSF after 30 years.

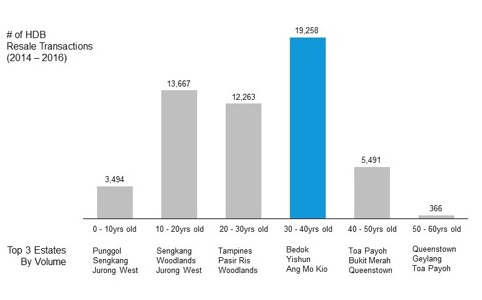

Assumption 2: Most Popular HDB Flats Are Always In The Central Area

When it comes to residential properties, location is a big factor in determining their demand and price. The common assumption is that home-buyers will pay a high price to stay near town. But our data tell us a different story:

The most popular resale HDBs are the 30-40 years old, with the most popular estates being Bedok, Yishun and Ang Mo Kio. If we look at the 0 – 20yr old resale HDBs, most of the transactions are in new estates where there continues to be new supply, including ECs.

So Where Are The Most Expensive HDB Flats In Singapore?

The most expensive HDB flat sold thus far is a 5-room unit at Pinnacle@Duxton which went for $1.12 million. The entire estate saw more than 10 transactions crossing the million dollar mark as of April 2017. Others include a couple of units at CityView@BoonKeng and Natura Loft in Bishan.

All of these million-dollar HDB flats share these common characteristics – proximity to MRT stations, situated in central/city-fringe and are all less than 10 years old.

But these flats are considered outliers – they make up less than 1 percent of the resale HDB market. Let us look at the table below for a more holistic view of the most expensive HDB estates:

Older HDB flats are likely to continue seeing strong demand especially if they are located in mature estates and offer a bigger space area compared to BTO flats. However, not all old HDBs command a high price; in fact, our research shows that HDBs that are less than 10 years old command a higher average price. For HDB flats that are more than 50 years old, the top 3 highest-priced flats were all for adjoined flats.

For HDB home-owners currently living in these areas, you could be sitting on some substantial capital gains and can therefore look out for selling opportunities. Cost-conscious home-buyers may want to re-think their assumptions and use the above data to inform their decisions.