TDSR, or commonly known as the Total Debt Servicing Ratio framework was implemented on 28 June 2013 to prevent buyers from becoming overburdened by debt due to property purchase. This framework replaces the former Debt Servicing Ratio of 50% that is used to determine the amount of income that can be spent on servicing debt.

How does TDSR work? Read on

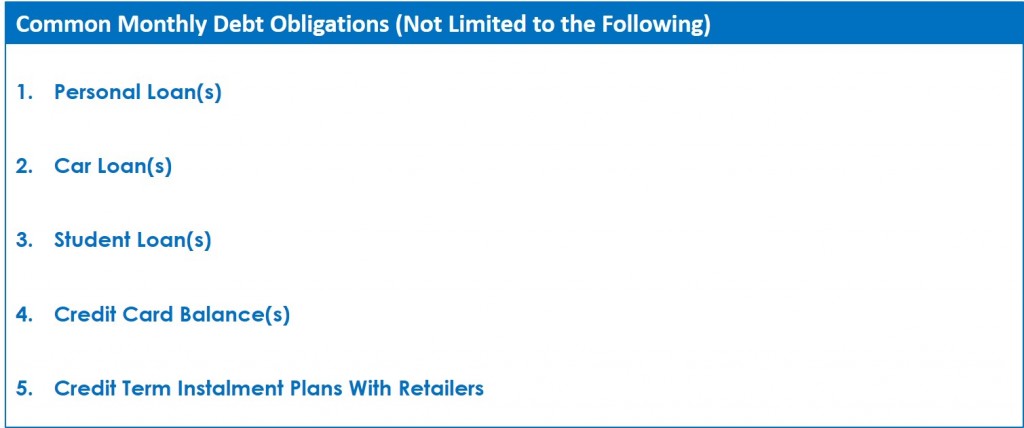

TDSR works by limiting the amount of loan you can obtain to 60% of your gross monthly income less your total monthly debt obligations. For individuals earning variable income (e.g commission based professionals, business owners or landlords), the TDSR will apply a 30% haircut on your gross monthly income before taking into account your monthly debt obligations

Assuming that your current gross monthly income is S$8,000

The total amount you have available to service all your debts monthly is S$4,800 (60% X S$8,000 = S$4,800). This however assumes that you have no existing monthly debt obligations. If you have monthly debt repayments of $1,500, this means your income available for mortgage repayment is $3,300. Assuming a stress-test interest rate of 3.5%, this means the maximum home loan you will be able to take is ~$730,000

What can you do if you exceed the 60% TDSR Cap?

• Consider repaying some of your outstanding loans to reduce your monthly debt obligations

• Adjust the loan tenor or reduce the loan quantum until you are below the required 60% threshold

• It may be possible to seek an exemption from the bank, however this is subject to approval

Exemptions

Borrowers can potentially seek exemption from the TDSR framework if you currently occupy the property and you do not own any other property or property loans

In theory, the use of TDSR is designed to impact individuals who have borrowed heavily for other reasons. So for those looking to buy private property in the near term, we would recommend holding off on all major purchases until then.

For those looking to refinance, look out for our next post on how TDSR impacts you. In the meantime, visit www.drea.sg for more property insights, analysis and negotiation points

Looking to buy, sell or rent a property in Singapore? Visit DREA.sg for instant, location based insights, analysis and negotiation points. Check with DREA the next time you are at a house viewing.

One thought on “What is Total Debt Servicing Ratio? How does it impact you?”

Comments are closed.