Property Market Outlook

Are Singaporeans overleveraged

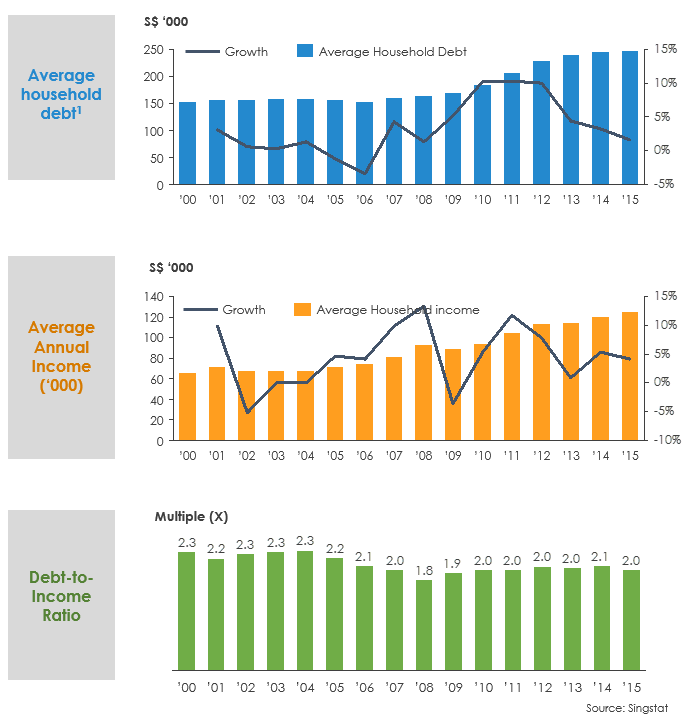

Household Debt vs. Income Growth

1. Household debt includes mortgage loans, car loans, credit card debt, and other personal loans

While absolute household debt has increased, debt-to-income ratio in Singapore has moderated

Household debt has been growing, but the increase was supported by income growth

Household debt includes mortgage and car loans, credit card debt, and other personal loans. For Singapore, average household debt has been increasing steadily after the financial crisis. The growth only started to slow since 2013 and debt levels stabilized between 2014 and 2015.

Although household debt level has been increasing, income has been growing as well. Annual Income per household has been on the rise since 2011, and over the past fifteen years, the overall household debt to annual income ratio has decreased. Debt-to-income ratio was 2.33 in year 2000, and 2.0 in 2015. In other words, on average, Singapore households are less leveraged now as compared to year 2000.

This implies that Singaporeans are better able to pay off their debt today as compared to the past. This is further validated by the decline in Non-performing Loans (NPL)

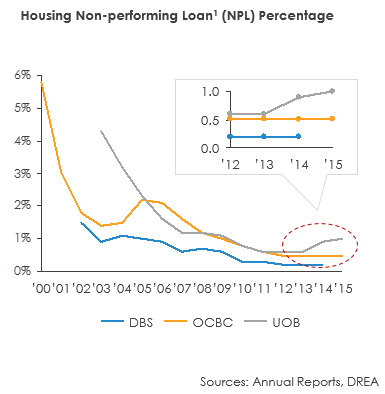

Majority of borrowers are capable of paying off their mortgage loans

Majority of borrowers are capable of paying off their mortgage loans

Housing non-performing loans refer to mortgage loans on which the borrower has not made payments according to the schedule for more than 90 days. There is a high risk of default on these loans, and the odds of the bank getting their money back is substantially lower. The housing NPL ratio is calculated by dividing the number of non-performing housing loans by the total number of outstanding housing loans.

There has been a drastic decrease in Housing NPL since 2000, and mortgage default rates are at an all time low.

1. Housing loans include private loans from banks and HDB housing loans

Housing NPL is less than 1% and the majority of borrowers are able to pay off their mortgage loans

Since 2013, there has been a meaningful decline in credit card loans as a % of household income

Since 2013, there has been a meaningful decline in credit card loans as a % of household income

Credit card loans as a percentage of household income has historically been on the rise. In 2013, it reached a peak of 90%.

The introduction of the total debt serving ratio in late 2013 was unsurprising and may have been the reason for the trend reversal.

Since the introduction of the TDSR, it is common to hear of locals tightening their credit card spend to maintain flexibility and room for taking on housing mortgage loans.

-Credit card charge-off rate is rising

The charge-off rate is an indicator of the percentage of debt that cannot be recovered. A higher charge-off rate suggests that people are increasingly dragging out their credit card payments.

We note that charge-off rate in 2014 and 2015 was even higher than that of 2009. This is unexpected because 2009 was the year when the global financial crisis hit Singapore the hardest. Unemployment rate was 3.2% in March 2009, and 1.9% in March 2015. This is a concern because data suggests that more people are unable to pay off their credit card debt in 2015 even when unemployment rate was lower.

Sources: Singstat, MAS

1. The charge-off rate is an indicator of the percentage of debt that will not recovered. Charge-off rate = amount of charge-offs/average outstanding balance owed by issuer

Credit card loans as a percentage of household income has declined but charge-off rates have increased as more people drag out payments

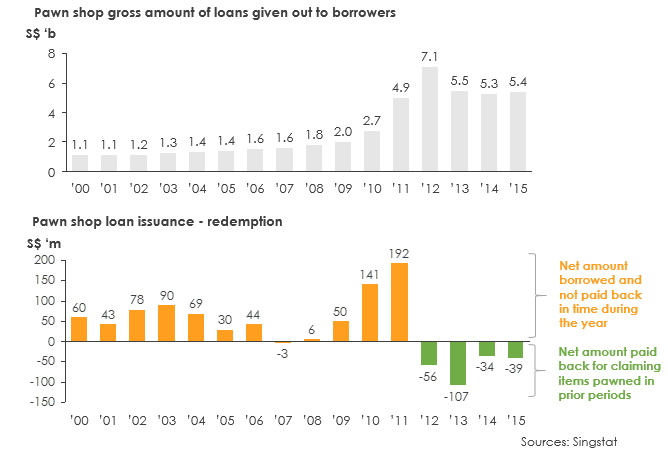

Pawnshop business provide further guidance on consumer borrowing

People usually turn to pawn shops when they are looking for short-term and small-dollar loan options that are not offered by banks. However, pawn shops only offer loans when the borrower secures the loan with an item of value, such as jewellery, watches, and gadgets. The pawnbroker will determine the value of the loan based on the value of the item secured.

Pawn shops do not do a credit check on the borrower, hence the borrowing process from a pawn shop is relatively shorter and easier as compared to banks and traditional lenders. Borrowers who are unable to take a loan from banks might try to take a loan from pawnshops by bringing in their assets which are of value.

Amounts borrowed from pawn shops had grown significantly since 2009 from the aftershock of the global financial crisis but has started slowing down since 2012. More importantly, people are starting to make claims for items pawned in prior periods. We view this as a positive sign, but are cautious about it.

Pawn shop loans have increased, but borrowers are now paying off loans in time and also claiming items pawned in past years