Property Market Outlook

A look at upcoming supply

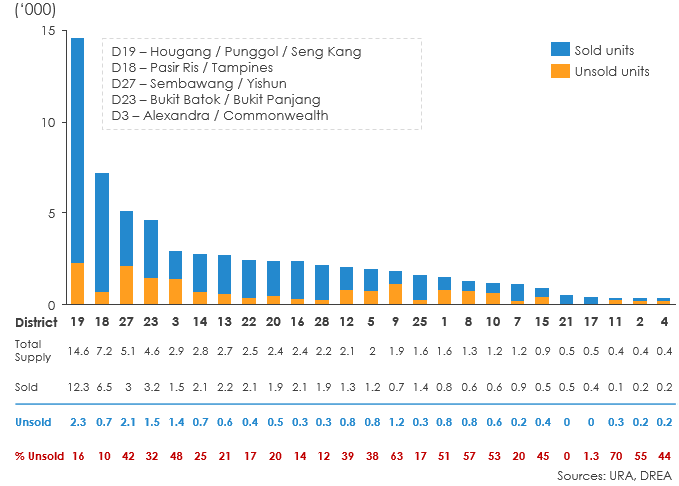

New Supply by Units (2016 - 2020)

There has been a surge in new private property construction, and this is especially so in districts 19, 18, 27 and 23. Given the upcoming supply, market observers have highlighted potential supply risk and potential price decline as supply volume outstrips buyer’s demand.

Today, there are ~17,230 unsold units in the new launch market. While there continues to be demand from HDB upgraders and foreign investors, some developments have had poor sales given unrealistic price expectations from developers. To win buyers, some developers are offering very attractive sales commissions to agents while others have experimented with innovative ways of lowering initial upfront cost as part of developer discount schemes

We estimate there are ~17,200 unsold units outstanding in the new launch market today

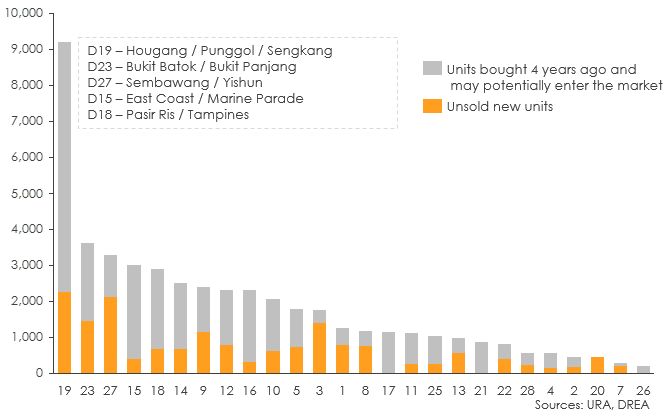

New supply – unsold new units and units bought 4 years ago that might enter the market

Buyers and sellers today are equally concerned about supply risk

Buyers worry about potential losses if they buy today and the risk of their home value declining because of the supply overhang. Sellers on the other hand face difficulties in selling their units given the volume of units (new and resale) available for sale out there in the market.

On top of the new supply, units brought 4 years ago are no longer subjected to Seller’s Stamp Duty (SSD) should they enter the resale market.

Owners of these units face less restrictions and there are less barriers to selling their properties now as they no longer have to pay a hefty tax on the sale. The chart above shows the total number of unsold new units, and the number of units bought 4 years ago that might potentially enter the market.

As potential supply risk affects both buyers and the sellers, this is a critical area to watch.

District 19 – Punggol, Hougang and Sengkang – has the highest volume of unsold units and also the highest volume of units exiting the 4-year SSD “lock-in” period

This is a buyer’s market and buyers should push hard for a good deal