It is very much a Singaporean dream to own a private property. Have you been thinking about upgrading to a condo? Or are you looking to buy one as your first home. Here are 7 things you should consider.

1. Find something that is right for you

At the risk of stating the obvious, this is nonetheless an important starting point. We often hear of friends who are buying a place because it’s a good deal, or because there’s upside etc.

Buying a house is an important personal decision and there are many factors to consider. Unless it is purely a financial investment, do take time to think through the following and decide what’s right for you.

2. Evaluate the location

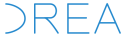

As the saying goes, it’s all about location, location, location. Consider amenities nearby, schools (if you have kids or plan on having one) and transportation access. Are there groceries or convenience stalls that are within walking distance? How long will it take to walk to the nearest train station? (Don’t be fooled by straight line distance). What about food options?

These are factors that cannot be quantified but nonetheless important considerations whether you plan to occupy the unit or to rent it out. DREA puts all of these together in one place so you don’t have to spend time ploughing through details on a map.

3. Be informed about prices

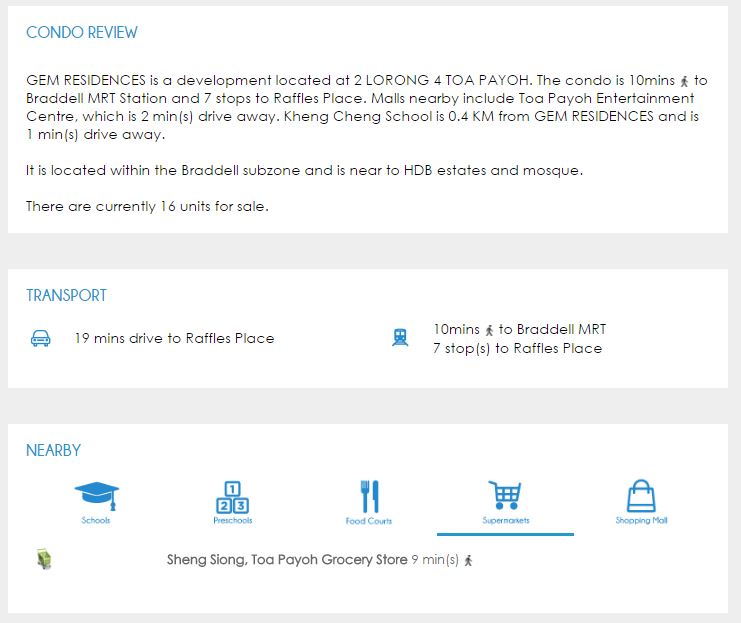

No one likes over-paying, particularly for a big ticket item like a house. In Singapore, information about property prices are widely available but it can be quite challenging to go through scores of past transaction caveats.

What is the price range for the area you are looking at? How much are similar units going for? How does tenure and unit sizes affect prices? Where are prices headed?

These are important questions when evaluating whether you are getting a good-deal, or whether there’s room for negotiation. Access DREA.sg on mobile with location services turned on to instantly see prices of residential property around you. Or visit drea.sg on your desktop and table to evaluate prices around a specific property like Sophia Hills

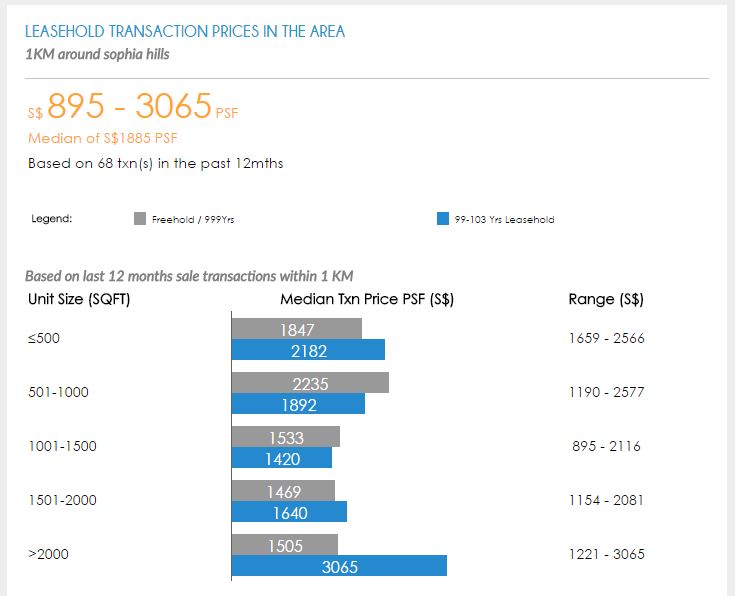

4. Take note of supply risk

You might already know this. 2016 is the year of peak completion. More than 21,800 units are due for completion this year and there are another 45,000 scheduled for completion in the next 3 years.

In which areas are “new supply” concentrated? How much of these are unsold units? If you are already looking at a particular location or property, how much supply risk are there in the area? It is prudent to consider potential downside risk given how prices have already come under pressure over the past 11 quarters.

5. Consider alternatives

The silver lining in the current market environment is that buyers have options – a lot of options indeed. In a buyer’s market, time is on your side. Take time to consider alternatives i.e. different tenure properties in the same area, other areas which are equivalent in prices or travel time.

This would allow you to weigh trade-offs and make well-informed decisions. Compare homes and look for like-for-like properties with DREA here

6. Plan your finances

This cannot be over-emphasized. Regulators have put in place the Total Debt Servicing Ratio (“TDSR”) restrictions to limit incidences of over-leveraging. It may be dismaying when such regulations restricts our ability to take on a home loan to finance a dream house. But it may also be a prudent reminder for good financial planning. So take time to work out your monthly expenses and cashflow. This would help set expectations on what would be a comfortable price range hunting for a property.

You may want to consider engaging an agent. Work with them to identify your budget, cashflow and preferences. Being involved in the market on a day-to-day basis, agents have a good sense of what’s available and you might even gain access to opportunities which are not publicly listed on portals.

You can reach out to any of DREA’s Agents on-the-go here [mobile only]

7. Get the right home loan

It is important to know your facts before deciding on a type of loan. For starters, there’s no fixed rate mortgages in Singapore. Those are just marketing terms and the rates are only “fixed” for 2-3 years.

Broadly, there are three main types of home loan rates in Singapore

- Home loan rates that are pegged to SIBOR (Singapore Interbank Offer Rate) or SOR (Swap Offer Rate)

- Board Rate

- Fixed Deposit Home Rate

How are these different? Which one should you go for? It’s really a function of your cashflows and view on interest rates. So do take time to compare different options

Stay tuned and look out for our next blog post: Part 2 – Find Something that is right for you

We spent the past 3 years putting ourselves in the shoes of a buyer – visiting showflats, viewing units and speaking with agents. We then built tools to make it a lot easier for everyone to get information, insights and analyses on condos and apartments in Singapore. That’s what DREA is all about.

Check with DREA the next time you are at a showflat or house viewing

2 thoughts on “Buying a Condo? Here are 7 things to consider”

Comments are closed.